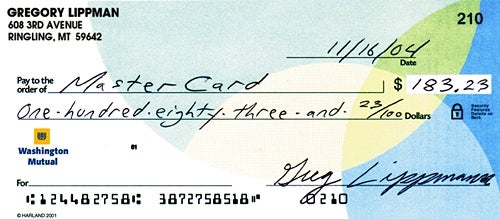

RINGLING, MT—A wild adventure pitting man against the forces of time ended happily, when, in spite of overwhelming odds, a personal check written by Greg Lippman, 33, cleared Monday.

“It’s done,” Lippman said, slumping back onto his sofa. “All the tension and drama is over: The check cleared.”

The saga began Nov. 17, when Lippman mailed a $183.23 credit-card payment to Mastercard. Lippman said he’d naively assumed that he had enough money in his Washington Mutual account to cover the check, until an unrelated conversation with his wife Kim revealed just how wrong he’d been.

“During dinner on Thursday, Kim mentioned that she went shopping for stuff for the kids’ lunches,” Lippman said. “I wasn’t really paying attention until she started complaining about how she had to spend close to $60 on lunch meat and yogurt and stuff. Then it hit me: There was only about $200 in our checking account. There was no way the check I’d mailed the day before was going to clear. My heart dropped into my stomach.”

Before panic set in, Lippman asked his wife for all the facts regarding the groceries. The conversation confirmed his fears: She had paid the Shop ’N Save grocery chain using the debit card on the couple’s joint checking account. Barring a miracle, the money would have been subtracted from the account immediately.

“I kept asking Kim if she was sure she didn’t use a credit card,” Lippman said. “She kept saying ’yes, yes.’ As much as it hurt to ask, I needed to know if there were any other checks she’d written that I might not be aware of. She said there weren’t.”

Continued Lippman: “’Think hard,’ I said. ’This is serious. Is there anything at all you might have overlooked? A check to your sister that she never cashed, maybe?’ She kept saying ’no, no, no.’ She was getting pretty ticked at me, but if there was another check out there, I had to know it.”

“Basically, the course of action was clear,” he added. “We had to get money in that checking account—fast.”

Lippman knew the money would not come from his employer.

“I get paid Friday, but not until the end of the day,” he said. “Even if I deposit the check at an ATM immediately after work, the earliest it shows up on my balance is Tuesday. I had to find another solution.”

According to Lippman, the bitter irony was that the Mastercard payment was not actually due until Dec. 5.

“It was a cruel twist,” he said. “Kim kept saying that the credit-card payment wasn’t even due for another three weeks, so there was no reason to mail it without talking to her. What could I say other than ’I know. I was wrong. I’m sorry’?”

Lippman said he believed Mastercard would attempt to cash the check within three days of the day it was sent, giving him until Monday to deposit money into his account and see it reflected on his available balance.

“I’d just cashed in my loose change two weeks ago, so my normal backup plan was out of the question,” Lippman said. “After spending all Thursday night considering my possibilities, I was convinced it came down to one option: finding someone who would give me a personal loan.”

Lippman’s friend and next-door neighbor, Jack Woodruff, entered the picture Friday morning.

“I’ve helped Jack out of a couple of scrapes,” Lippman said. “He owed me, but I knew that he might not actually have the money.”

“Thank God he did,” Lippman added.

Woodruff wrote a $45 check out to Lippman, but warned him that it could take a couple days to clear.

“He’s a contractor who lives in Florida during the winter, so his checks are from down there,” Lippman said. “He said banks sometimes hold out-of-state checks until they clear, so I thought it was over. But then providence smiled: We both had Washington Mutual checking accounts.”

Lippman’s adventures were not over.

“I had to get to the bank first thing Friday, or the whole plan would fall apart,” Lippman said. “But I couldn’t be late for work Friday, because I had a conference call with the regional managers.”

Knowing that the conference call was scheduled for 9 a.m., the same time his bank opened, Lippman reluctantly asked his wife for help.

“I didn’t want to get Kim involved, but there was no other option,” he said. “On Friday morning, she got up with me. Before I left for work, she hugged me. Then she looked me square in the eyes and told me that she knew I was only trying to help out when I paid the Mastercard bill in advance. It meant a lot.”

After he arrived at work Friday, Lippman attempted to call his wife every 45 minutes. When she finally got home that afternoon, he received some long-awaited good news: His wife had deposited the check with no complications.

Checking his account balance online Monday, Lippman rejoiced to find that his plan had worked, and the check had cleared with $1.38 to spare. He said he was “finally able to breathe easy.”

“We did it—we got the money in, and we didn’t have to pay an overdraft charge,” Lippman said. “Man, I really gotta get one of those checking accounts with an overdraft line of credit. I never want to go through this again.”