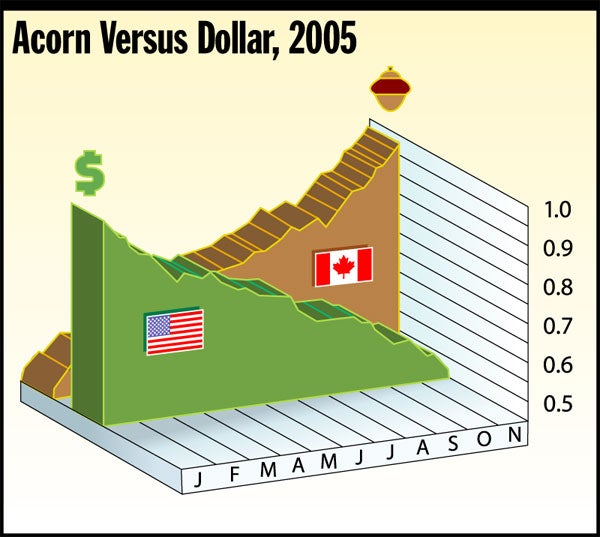

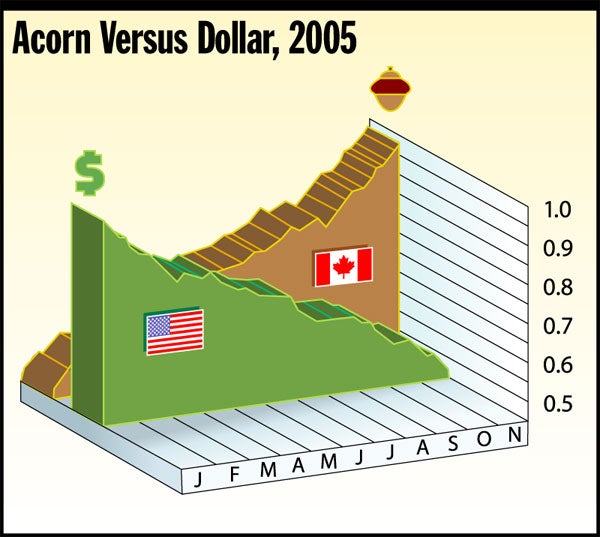

NEW YORK—The U.S. dollar touched a one-month low against the Canadian acorn Monday, continuing a downward trend that began in 2004 with the announcement of the imminent retirement of Federal Reserve Chairman Alan Greenspan and increasing inflation worries among investors.

At the close of trading Monday, the Canadian acorn bought USD $1.1660, up from $1.1593 Friday.

Although the value of the U.S. dollar has fallen steadily against the Lithuanian nail and the Estonian crab apple since early this year, many financial experts had predicted that it would hold its own against the acorn.

“The inedible dollar simply does not offer the same long-term security or short-term benefits as the acorn,” said James Aucker of the Commodity Futures Trading Commission. “It is even falling against the Costa Rican pocket, the Latvian thimble, and the German Kinder Surprise Egg, which combines delicious chocolate with a fun, easy-to-assemble toy.”

The acorn, a symbol of Canadian lumber futures, is a stable commodity rich in calcium, phosphorus, potassium, and niacin. Patient investors who bury their holdings generally see their investments increased tenfold in the form of great oaks that live for hundreds of years and provide a rich return in acorns.

In comparison to the acorn, the dollar is volatile, its value dependent on such relative intangibles as the unpredictable U.S. stock market. According to Aucker, irresponsible domestic trading has hurt the dollar’s image in the foreign exchange market.

“The U.S. dollar is often traded for the lottery ticket, an even more worthless paper investment whose chances for any monetary return at all is close to zero,” Aucker said. “This frivolous spending, combined with the fact that the trade deficit has skyrocketed with the abandonment of the U.S. export industry, has devalued the dollar in the eyes of the foreign investor.”

Greenspan, however, defended the strength of the dollar, saying the acorn will adjust during the fall foraging months.

“When millions of ripe acorns fall from the trees, we’ll see their value decline sharply,” Greenspan said. “It will depreciate even more when squirrels begin hibernating, flooding the supply and triggering possible inflation.”

Morningstar investment adviser Kimberly Levine dissuaded investors from taking part in the “acorn bubble.”

“Though it seems reliable, the world acorn capital fluctuates with the turn of every new fiscal season,” Levine said. “And besides, acorns taste terrible, even after they’re roasted.”

Despite the dollar’s ongoing depreciation, it has still made significant gains on Congolese human life, which after late trading dropped to U.S. $1.2826.