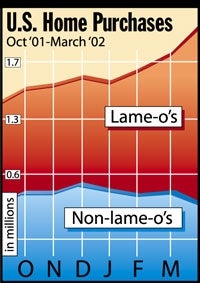

WASHINGTON, DC—In the first quarter of 2002, sales of new U.S. homes rose 5.3 percent among Dockers-wearing, Pictionary-playing lame-o’s, the Commerce Department reported Monday.

“This is encouraging news for the U.S. economy,” Commerce Secretary Don Evans said. “For three straight months, home-buying statistics have been robust, with March housing starts peaking at a seasonally adjusted rate of 1.66 million units. Mr. and Mrs. Suburban Dork are scooping up houses like there’s no tomorrow.”

Though housing-industry analysts can’t understand why any thinking person would want to be saddled with a hefty mortgage and consign themselves to a depressing, isolated whitebread existence, they say falling interest rates represent the primary reason for the surge. The Federal Reserve, which has repeatedly cut interest rates in an effort to slow down the recession and stimulate consumer spending, took pains to distance itself from the trend.

“The Federal Reserve Board may have stimulated home-buying with its interest-rate cuts,” Federal Reserve Chairman Alan Greenspan said. “But that doesn’t mean any of us would ever want to live in a split-level ranch in some soulless gated community near Phoenix, where we’ll obsess over golf and property values. Promise you’ll shoot me if it ever comes to that.”

According to Kiplinger’s senior writer Peter Akkaf, in addition to buying more homes, lame-o’s are refinancing existing mortgages to take advantage of lower rates.

“Lame-o’s across the country are making appointments at financial institutions to ask men in ugly neckties and women with hairstyles 10 years out of style to adjust their mortgages to a slightly more favorable rate,” Akkaf said. “When that’s done, they return to their homes, where they stare at their $12.99 Monet prints from Target and listen to Andrea Bocelli on their mini-stereos. What kind of life is that?”

Asked if the recent warm temperatures could have goosed the market, National Realtors’ Board president Maggie Zadora rolled her eyes.

“God, if that’s true, that’s sad,” Zadora said. “It’s like, ’Ooh, Mary, it’s 10 degrees warmer outside! Instead of going out and doing something fun or creative, let’s all pile into the minivan and search for the bland colonial of our dreams!’”

Alan and Laurie Butterfield of Glen Burnie, MD, are among the many lame-o’s to take advantage of the favorable buying conditions. Last month, they purchased their first home, a three-bedroom split-level in a featureless suburban subdivision near Baltimore.

“We’d rented for so long, we figured we probably could have paid off half a mortgage by now,” said Laurie, 33, who hasn’t been out on a Saturday night in months. “So with the interest rates down and both of us working steadily, this seemed like the perfect time to get a house.”

“With a child on the way, we wanted to move to someplace with a lot more space and good public schools,” said Alan, 34, sporting a tucked-in polo shirt embroidered with his company’s logo. “It’s also a good investment. Our neighborhood didn’t even exist 10 years ago, and already the housing values have increased by one-third from their 1996 estimates.”

The Butterfields’ decision impressed Money columnist William Ross.

“Very smart move, Alan and Laurie,” said Ross, facetiously tapping his temple. “Thanks to your tremendous savvy and financial acumen, you now have a brand-new place to hang your wind sock. Fabulous. Have fun being chained to a mortgage for the next 30 years.”

Housing-industry experts say the surge in home buying indicates increased confidence in the U.S. economy on the part of lame-o’s.

“Purchasing a home is not the act of a pessimist,” said Frank Nothaft, chief economist at Freddie Mac. “But it is the act of a dweeb. Sure, renting costs more over time than owning, but do you want to spend your weekends cleaning out leaf gutters and fixing the garage-door opener, or do you want to be happy? Life is way too short, people. Loosen up.”